Are there bets with guaranteed positive return on the prediction market PredictIt?

Yes and no. “Yes” because examples of such bets do exist. “No” because these bets have negative present-value adjusted returns. (Bets with guaranteed positive returns are called “sure bets.”)

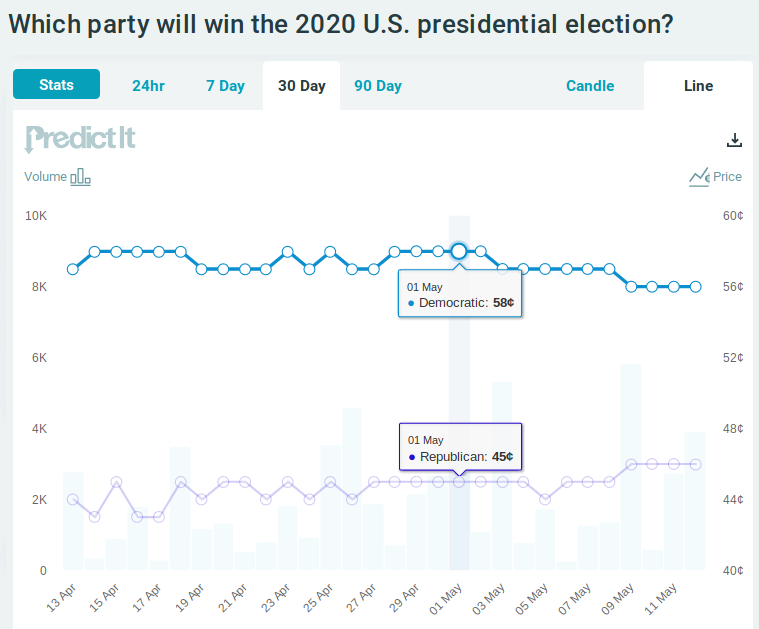

Here is one example of a bet which does indeed have a guaranteed positive return. During the spring of 2019 (e.g., April 28 to May 2) you could purchase two contracts in the 2020 U.S. presidential election market on PredictIt which, together, paid off 100¢ with certainty and cost 99¢. Specifically, you could purchase the following two contracts:

- a contract which costs 0.43 paying out 1 if the Republican Party candidate does not win, and

- a contract which costs 0.56 paying out 1 if the Democratic Party candidate does not win (which pays out if the Republican wins).

So for 0.99 you can receive 1 if the Republican candidate wins or does not win. As the probability of this bet paying out is 100%, this contract is guaranteed to yield a profit of 0.01. As this particular market is one of the most liquid markets on PredictIt, you could purchase 1517 of each contract for a total of $1501.83–PredictIt imposes a limit of $850 invested in a single contract market–and be guaranteed to receive $1517, making a profit of $15.17. This bet qualifies as a sure bet.

Figure 1: A sure bet on PredictIt. The sure bet shown here was available during several days in May 2019. This sure bet consists of wagering against the Republican candidate winning and also against the Democratic candidate winning. (This second wager is equivalent to betting on the Republican candidate winning.) Making these wagers costs less than 1. The bet against Republican costs 43¢ (100¢ - 58¢ + 1¢) and the bet against Democrat costs 56¢ (100¢ - 45¢ + 1¢). (The spread, in both cases, was 1¢.) Purchasing one of each contract costs 99¢.

Figure 1: A sure bet on PredictIt. The sure bet shown here was available during several days in May 2019. This sure bet consists of wagering against the Republican candidate winning and also against the Democratic candidate winning. (This second wager is equivalent to betting on the Republican candidate winning.) Making these wagers costs less than 1. The bet against Republican costs 43¢ (100¢ - 58¢ + 1¢) and the bet against Democrat costs 56¢ (100¢ - 45¢ + 1¢). (The spread, in both cases, was 1¢.) Purchasing one of each contract costs 99¢.

Before you get out your wallet, recall that purchasing a contract in this market pays out in November 2020. Taking into account the present value of the future income stream makes the return on the bet negative. As the risk-free interest rate in May 2019 was 2.31%, the present value of a cash flow of $1,517 in 18 months is $1,465.91 ( \(\frac{1517}{(1+0.0231)^{18/12}}\) ). Hence the present-value-adjusted return on the investment of $1501.83 is an unattractive -2.4%. You would be better off investing the $1501.83 in a high-yield savings account.

This post is part of a series. The most recent post in the series is “The Present Value of a Bet’s Payoff.” Learn when new posts appear by subscribing (RSS).