A market is a tool for matching buyers with sellers. Electronic markets are a particular kind of market. This note introduces three concepts used in virtually all electronic markets in the early 21st century: bids, offers, and the bid-offer spread. This note discusses these concepts in the context of a prediction market, a particular kind of electronic market.

Sellers post offers to sell a quantity of a known product at a specified price (e.g., 50 metric tons of corn for 185 USD). A market aggregates and makes visible these offers for prospective buyers. In summaries of current market activity, the market typically makes visible the offer associated with the lowest price (“lowest offer”). Often there is no buyer interested in buying the product at this lowest offer. (In the jargon, we say there is no buyer willing to pay an offer.) In this situation, sellers leave an offer in the hopes that a buyer may eventually arrive who is interested in paying the quoted price. Provided an offer has not been paid, sellers may typically cancel offers at any time.

Buyers post bids to purchase a quantity of a known product at a specified price. Again, a market aggregates and makes visible these bids for prospective sellers. In summaries of current market activity, the market typically shows the highest bid. If there is no seller interested in selling the product at a price a buyer is willing to pay—in the jargon, no seller is willing to give a bid—the buyer leaves a bid in the hopes a seller may arrive who is interested in selling at the quoted price.

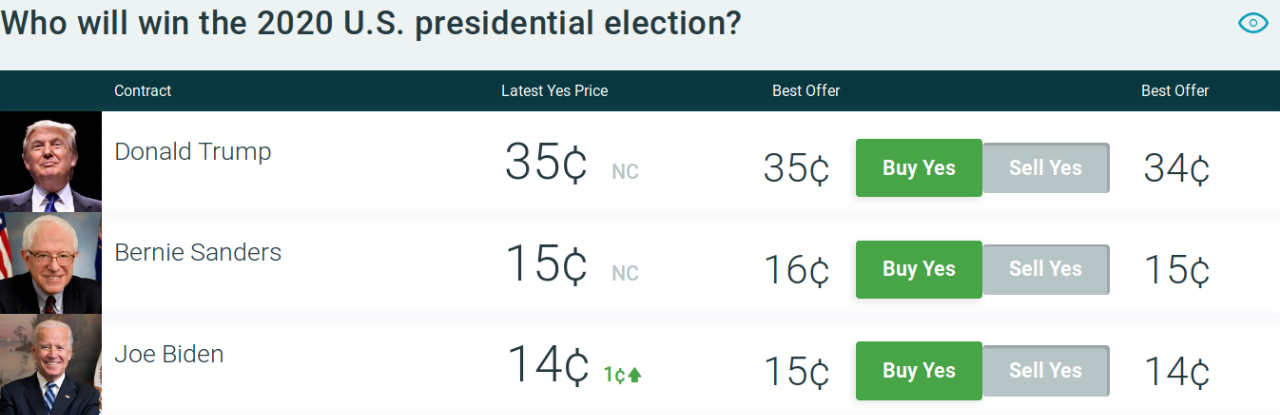

The difference between the price associated with the highest bid and the price associated with the lowest offer is the bid-offer spread. In a functioning market the bid price is lower than the offer price. Hence we use the term bid-offer spread (rather than the offer-bid spread). Large spreads are the norm. Only with heavily traded products does the spread tend to be small. A screenshot of summary information about three contracts traded on a prediction market in early 2019 is shown as Figure 1. In the screenshot you can see the following information for each contract: the price at which the last successful trade occurred, the lowest offer, and the highest bid.

Figure 1: Bid-offer spreads for three contracts concerning the 2020 United States presidential election. Bid and offer prices are not labeled according to standard conventions. The price in the second column of prices is associated with the lowest offer. The price in the third column is associated with the highest bid. The bid-offer spread for all three contracts is 0.01 USD.

Figure 1: Bid-offer spreads for three contracts concerning the 2020 United States presidential election. Bid and offer prices are not labeled according to standard conventions. The price in the second column of prices is associated with the lowest offer. The price in the third column is associated with the highest bid. The bid-offer spread for all three contracts is 0.01 USD.

Making skillful use of an electronic market requires being familiar with bids, offers, and the bid-offer spread. Buyers communicate how much they are willing to pay for a product by posting bids. Sellers indicate their willingness to sell by posting offers. Very frequently there is a gap between the highest price associated with a bid and the lowest price associated with an offer. This gap is the bid-offer spread. When a product is infrequently traded, the bid-offer spread tends to be large. Even when no trades occur, buyers and sellers learn something about supply of and demand for a product.

This post is part of a series. This is the first post in the series. Learn when new posts appear by subscribing (RSS).