Participation in prediction markets has a social benefit: a market’s prediction provides a useful baseline against which other predictions (outside the market) may be judged. A market’s prediction can also be useful to individuals making decisions that depend on the outcome of the predicted event. In both cases, the social utility provided by the market remains even if the market’s prediction is not perfect. The market is useful even if it only provides a general assessment of the relative probabilities of different outcomes.

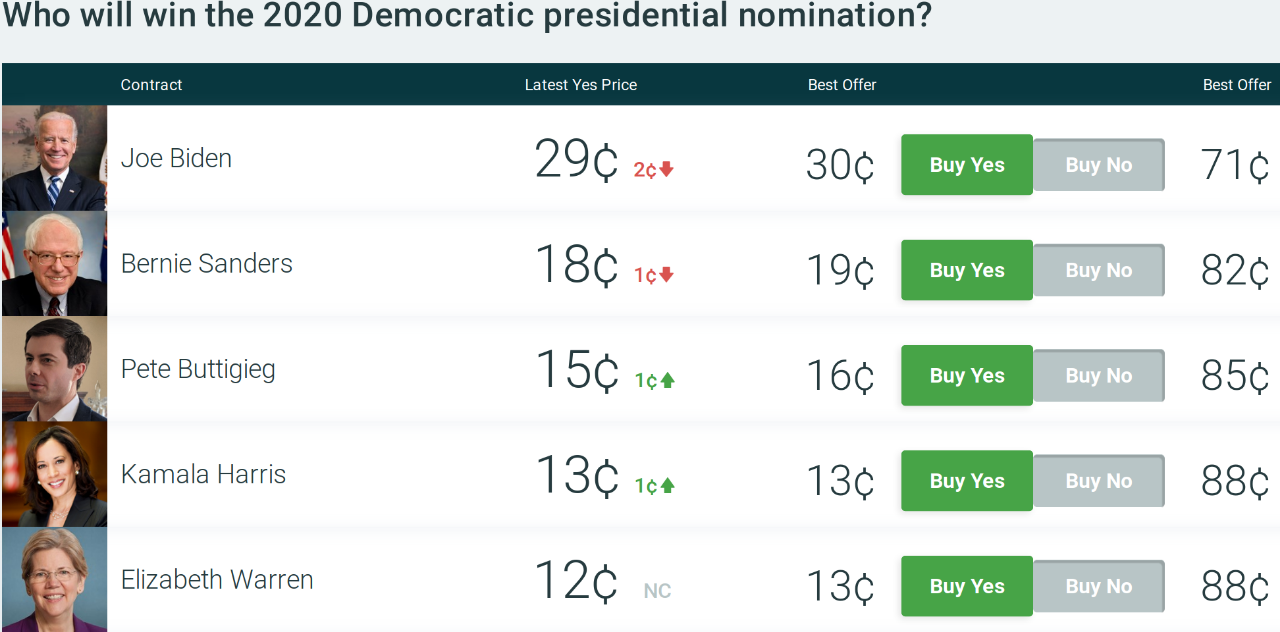

Prediction markets provide baseline predictions about uncertain events. Consider the task of predicting which candidate will receive the US Democratic party’s presidential nomination in 2020. In May 2019 there were 23 candidates for the nomination. The thought that each candidate is equally likely to win the nomination does not merit being described as a baseline prediction. Some candidates have a far better chance than others. Here the prediction market gives the public a general sense of which candidates are better positioned than others (Figure 1). And the public gets this for no cost.

Figure 1: The probability of one of these five candidates winning is 87%, in the judgement of PredictIt participants in late May 2019. There are many other candidates in this race. The prediction market here tells us that some candidates stand a far better chance than other candidates.

Figure 1: The probability of one of these five candidates winning is 87%, in the judgement of PredictIt participants in late May 2019. There are many other candidates in this race. The prediction market here tells us that some candidates stand a far better chance than other candidates.

The utility of having a baseline prediction is easy to appreciate in the case of political events. With political events, we have political commentators and polling firms which deliver forecasts of what will happen. It is natural to ask whether or not these commentators or firms are skilled at forecasting. Given that polling is expensive and salaries for political commentators are non-zero, we anticipate that their predictions will approach or exceed a certain standard of utility. One standard we can use is the following: ask that their predictions tend to be more accurate than those made by prediction markets. Having prediction markets provide a standard here is particularly valuable because there are typically no other standards we can use. We cannot, for example, ask the commentator or firm to do better than the “prediction” which assumes each candidate has an equal chance of winning because virtually anyone can make better predictions than that. Prediction markets prove their worth by providing a baseline in settings where non-trivial baselines are scarce.

Consider participating in a prediction market. Even if your wagers fail to pay out, the public stands to benefit.

This post is part of a series. The most recent post in the series is “Are there Sure Bets on Prediction Markets (such as PredictIt)?.” Learn when new posts appear by subscribing (RSS).